Tana West

for

Assessor

I'm glad you're here. Understanding who handles your property assessments matters, so I want to show you exactly what I bring to this role.

Endorsements and Support

Experience and Qualifications

A Record You Can Trust

For over 30 years, I've dedicated my career to protecting the integrity of Oregon's property tax system. I started as an appraiser at 21, later became Chief Appraiser, and for the last 24 years have served as Deputy Director (Deputy Assessor)—the operational leader of the Deschutes County Assessor's Office.

It's not just about appraising properties. I oversee the entire tax roll: calculating rates for all 56 taxing districts, managing urban renewal impacts, and ensuring compliance with state law. This work governs $85 billion in real market value and generates nearly $600 million annually for schools, fire districts, cities, and other essential services.

Leading Through Innovation

I don't just maintain the status quo—I've worked to make our office more transparent and accessible so you can get answers without jumping through hoops. I designed and launched tools like the Tax Estimator (so homeowners can plan ahead before building), interactive tax breakdowns (so you can see exactly where your dollars go), and expanded online access to property records. These weren't handed to me—I identified the need, worked with IT to build them, and made sure they're easy for you to use.

⚖️ The Cost of Getting It Wrong

While property values can be appealed, errors in tax rates or calculations affect every taxpayer and districts. Mistakes may mean reissued statements, financial corrections, and serious legal risk. If the tax roll is wrong, there's no quiet fix-everyone sees it, and trust is damaged. I've implemented a multi-step audit process—sometimes used by other Oregon counties—to catch errors before they can occur and become expensive problems.

📈 Experience You Can't Fast-Track

The tax roll happens once a year. Mastering the timing, dependencies, and risks takes years of repetition. I've been consulted by other assessors in Oregon on complex calculations and new procedures. That institutional knowledge protects you-and it can be learned quickly, it takes years.

🛡️ Leadership Without a Learning Curve

With our current Assessor retiring, Deschutes County can't afford disruption. I'm ready to lead from day one—maintaining accuracy, efficiency, and your trust.

My Priorities

✓ Expand transparency through online tools that help you understand your assessments

✓ Support our staff with technology and training to manage growth efficiently.

✓ Protect accuracy so you and essential services can rely on the tax roll

🗳️Vote Tana West - Experience You Trust

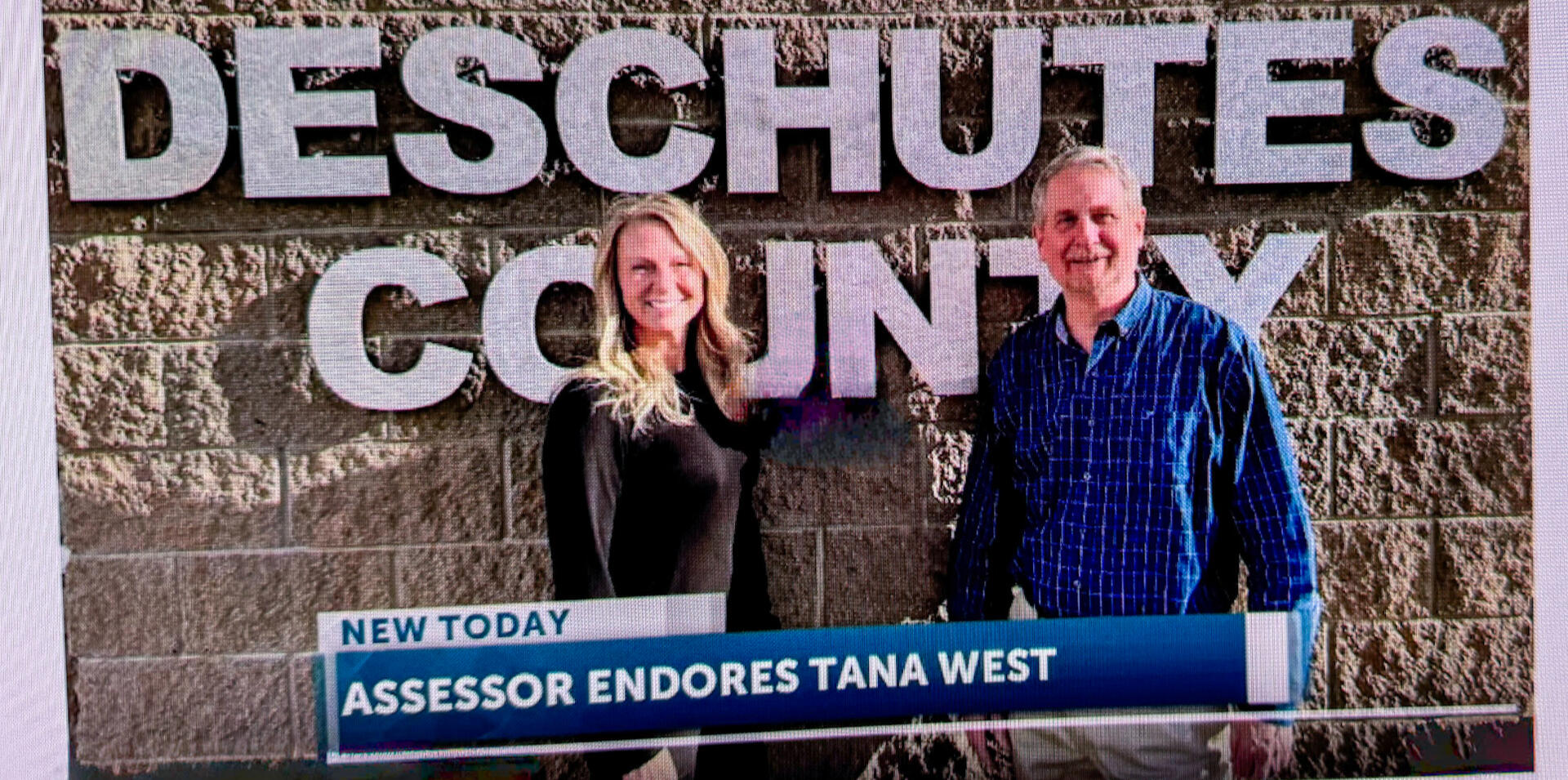

ENDORSEMENTS

"Tana has been our office's backbone for decades. Her experience is unmatched, and I have complete confidence in her ability to lead." Scot Langton, Deschutes County Assessor (Retiring)Ray Soltis, Jefferson County AssessorBill Kuhn, Deschutes County TreasurerJon Soltis, Crook County AssessorJean McCloskey, Former Jefferson County AssessorTim Lutz, Former Tillamook County Assessor, and Bev Lutz

Programs that Matter

💰 You might qualify for property tax relief and not know it.

If you're a senior on a fixed income or have a disability, disabled veteran or surviving spouse, or your home was damaged by fire or Act of God, Oregon has programs that can defer or reduce your property taxes. Our office processes these applications—and I'm committed to making sure every eligible resident knows these programs exist.📊 You can estimate your taxes before you build

Planning a remodel or addition? I helped create the Tax Estimator tool so homeowners can see how construction might affect their future tax bill—before they break ground. You can also see an estimate of property taxes using our interactive tools.🔍 All property records are public and online.

Want to check sale prices? See tax history? It's all at www.dial.deschutes.org—free and easy to use.The Assessor's Office should help you, not confuse you. That's been my approach for 25 years, and it's how I'll continue to lead.➡️ Learn more:

🎖️ Veteran & Surviving Spouse Exemptions

🚒 Disaster Relief Information

📑Senior & Disabled Tax Deferral

Fun Facts

📜Property taxes in Oregon began in 1844—15 years before statehood! The Provisional Government of Oregon created the first property tax, and in 1854, the tax code was modernized to create the system we use today. Oregon became a state on February 14, 1859.🏔️Deschutes County was established in 1916 (formerly part of Crook County).👔Deschutes County's first Assessor was W.T. Mullarky in 1917. Since then, we've had only 13 Assessors in over 100 years. Our current Assessor, Scot Langton, is the longest-serving at 25 years.👩A woman in office in 1938? Yes! Deschutes County had one female Assessor—Marguerite H. Lyons—who was appointed for two months in 1938 after Assessor W.F. Hammer passed away in office. But here's the kicker: as far as we can tell, no woman has ever actually run for County Assessor until now.What was taxable over the years?💰1917–1940: Dogs🐕 were taxed (they became licensed in 1941 instead)

1917–1965: Horses🐴 and other livestock were assessed

1921: Chickens🐔 added to the tax rolls

1930: Foxes🦊

1938: Rabbits🐰

1965: All animals became exemptOther interesting additions:1922: 🎖️The first Soldiers Exemption began (later expanded to Veterans and Widows in 1941)

1940: 💡The first neon sign was added to the tax rolls

1941: ✈️The first airplane was added to the tax rolls

1957: "Trailer houses" appear on the rolls🏹 And yes, the Sheriff was the tax collector (think Robin Hood!) until 1973, when the legislature enacted ORS 311.070 allowing counties to have administrative staff "deputies" collect taxes instead.

Ready to Get Involved

This campaign is powered by neighbors like you—and it's working. Yard signs are going up across the county, endorsements keep coming in, and voters are responding to a message of experience and steady leadership.

Here's how you can be part of it:

📍 Get a Yard Sign Show your support and help spread the word in your neighborhood. Every sign matters.🤝 Volunteer - Know a great location, or want to help with placement? Even an hour makes a difference.📢 Spread the Word - One of the most powerful ways to help is sharing our message with you know:

~ Follow and share our posts on Facebook and Instagram.

~Like, comment, and help our posts reach more of your friends and neighbors.

Want to do more? Become a Digital Captain; we'll give you a simple plan, key dates and ready-to-share content so you can be effective when it matters most.💚 Contribute

Every contribution - large or small, is appreciated and funds yard signs, voter outreach, and getting our message in front of voters across Deschutes County.Thank you for being part of this team. Together, we'll protect the integrity and professionalism Deschutes County deserves ~ Tana

Let us know where to bring a yard sign or how you’d like to help!